Frequently Asked Questions

How can dealerships maximize profitability through reinsurance strategies?

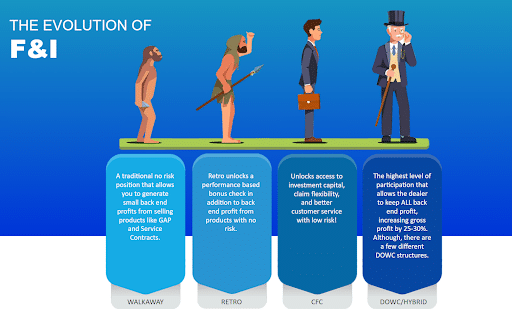

Dealerships can maximize profitability through reinsurance strategies by implementing tailored reinsurance structures, such as Walk Away Programs and Controlled Foreign Corporations (CFCs), that align with their specific goals and enhance control over F&I products.

What are the key components of dealership reinsurance programs?

The key components of dealership reinsurance programs include risk management structures, funding mechanisms, regulatory compliance, and profit-sharing arrangements, all designed to enhance profitability and control over F&I products for auto dealerships.

How do Walk Away Programs work in dealership reinsurance?

Walk Away Programs in dealership reinsurance allow dealers to mitigate risk by transferring potential losses to a reinsurance entity. This structure enables dealerships to exit from certain liabilities while maintaining control over their F&I products, ultimately enhancing profitability.

What insights can help dealerships control F&I products effectively?

Insights that help dealerships control F&I products effectively include understanding reinsurance structures, implementing transparent processes, and leveraging data analytics to track performance. These strategies enhance profitability and align F&I offerings with dealership goals.

What are the benefits of understanding tax implications in dealership profit participation programs?

The benefits of understanding tax implications in dealership profit participation programs are significant. Knowledge of these implications allows dealerships to optimize their financial strategies, enhance profitability, and ensure compliance, ultimately leading to better decision-making and increased financial control.

How can dealerships enhance reinsurance profitability?

Dealerships can enhance reinsurance profitability by implementing tailored reinsurance structures, such as Walk Away Programs and Controlled Foreign Corporations (CFCs), while aligning their strategies with overall dealership goals to maximize financial returns.

What factors influence dealership reinsurance success?

The factors that influence dealership reinsurance success include strategic alignment with dealership goals, effective risk management practices, and the choice of appropriate reinsurance structures. These elements collectively enhance profitability and control over F&I products.

How do dealerships choose effective reinsurance strategies?

Dealerships choose effective reinsurance strategies by assessing their specific goals, evaluating different structures like Walk Away Programs and Controlled Foreign Corporations (CFCs), and aligning these options with their overall profitability objectives.

What are common pitfalls in dealership reinsurance?

Common pitfalls in dealership reinsurance include inadequate understanding of reinsurance structures, misalignment with dealership goals, and failure to regularly evaluate program performance, which can hinder profitability and control over F&I products.

How can dealerships assess reinsurance program effectiveness?

Dealerships can assess reinsurance program effectiveness by analyzing key performance indicators such as profitability, loss ratios, and customer satisfaction, while also comparing results against industry benchmarks to ensure alignment with their financial goals.

What role does tax planning play in reinsurance?

The role of tax planning in reinsurance is crucial for maximizing profitability and ensuring compliance. Effective tax strategies can help dealerships minimize tax liabilities and optimize the financial benefits of their reinsurance structures.

How can dealerships structure profit participation programs?

Dealerships can structure profit participation programs by creating clear criteria for participation, aligning incentives with dealership goals, and implementing transparent tracking systems to monitor performance and profitability of F&I products.

What are the advantages of Walk Away Programs?

The advantages of Walk Away Programs include reduced financial risk for dealerships, enhanced cash flow management, and the ability to retain more profits by minimizing claims. These programs provide a strategic approach to managing F&I product liabilities effectively.

How do Controlled Foreign Corporations benefit dealerships?

Controlled Foreign Corporations (CFCs) benefit dealerships by providing tax advantages, enhancing profitability, and allowing for greater control over F&I products. They enable dealerships to manage risks effectively while maximizing returns on their reinsurance investments.

What metrics measure reinsurance program success?

The metrics that measure reinsurance program success include profitability ratios, loss ratios, and return on equity. These indicators help dealerships assess the effectiveness of their reinsurance strategies and overall financial performance.

How can dealerships improve F&I product control?

Dealerships can improve F&I product control by implementing structured reinsurance strategies, such as Walk Away Programs and Controlled Foreign Corporations (CFCs), which align with their financial goals and enhance profitability through better oversight and management of F&I products.

What are best practices for dealership reinsurance?

Best practices for dealership reinsurance include selecting the appropriate reinsurance structure that aligns with dealership goals, regularly reviewing performance metrics, and educating staff on F&I products to maximize profitability and enhance control over financial outcomes.

How do market trends affect dealership reinsurance?

Market trends significantly affect dealership reinsurance by influencing the demand for F&I products and altering risk assessments. Staying attuned to these trends enables dealerships to adapt their reinsurance strategies, optimizing profitability and ensuring alignment with current market conditions.

What training is essential for reinsurance staff?

Essential training for reinsurance staff includes understanding reinsurance structures, compliance regulations, risk assessment, and financial analysis. Additionally, training in customer service and communication skills is crucial for effective client interactions and relationship management.

How can dealerships leverage data in reinsurance?

Dealerships can leverage data in reinsurance by analyzing customer trends and claims history to optimize their F&I product offerings, enhance pricing strategies, and improve overall profitability through informed decision-making.

What legal considerations impact dealership reinsurance?

Legal considerations impacting dealership reinsurance include compliance with state and federal regulations, tax implications, and the structuring of reinsurance agreements to ensure they align with legal standards and dealership objectives.

How do customer relationships influence reinsurance outcomes?

Customer relationships significantly influence reinsurance outcomes by fostering trust and loyalty, which can lead to increased product uptake and lower claim rates. Strong connections with customers enhance overall profitability and stability in reinsurance strategies.

What innovations are shaping dealership reinsurance today?

Innovations shaping dealership reinsurance today include advanced technology solutions for data analytics, enhanced risk management tools, and customizable reinsurance structures that align with dealership goals, ultimately driving profitability and operational efficiency.

How can dealerships mitigate risks in reinsurance?

Dealerships can mitigate risks in reinsurance by implementing robust underwriting practices, diversifying their product offerings, and regularly reviewing their reinsurance structures to ensure alignment with business goals and market conditions.

What are the tax benefits of dealership reinsurance?

The tax benefits of dealership reinsurance include the ability to defer taxes on profits generated from reinsurance activities and potential deductions for losses, which can enhance overall profitability and cash flow for dealerships.

How can dealerships optimize their F&I offerings?

Dealerships can optimize their F&I offerings by aligning products with customer needs, enhancing staff training, and leveraging data analytics to identify profitable trends. This strategic approach maximizes customer satisfaction and boosts overall profitability.

What strategies enhance customer trust in reinsurance?

Strategies that enhance customer trust in reinsurance include transparent communication about policies, demonstrating a commitment to ethical practices, providing clear explanations of coverage options, and showcasing successful case studies that highlight positive outcomes for clients.

How do economic conditions affect dealership profitability?

Economic conditions significantly impact dealership profitability by influencing consumer purchasing power, financing options, and overall market demand. During economic downturns, dealerships may experience reduced sales and tighter margins, while favorable conditions can enhance profitability through increased vehicle sales and higher F&I product uptake.

What resources are available for reinsurance education?

Resources available for reinsurance education include industry webinars, online courses, and comprehensive guides from experts like F&I Direct. These materials help dealerships understand reinsurance strategies and enhance their profitability.

How can dealerships align reinsurance with business goals?

Dealerships can align reinsurance with business goals by selecting structures that enhance profitability and control, such as Walk Away Programs or Controlled Foreign Corporations (CFCs), ensuring these choices support overall strategic objectives.