In the contemporary automotive industry, one term that has been gaining significant momentum is Protective DOWC, an acronym for Dealer Owned Warranty Company. Although it has been in the marketplace for over four decades, the Protective DOWC is not universally understood, leading to misrepresentation and inaccurate information about its structural, financial, and tax attributes. This article aims to demystify the process and considerations involved in setting up a Protective DOWC, providing valuable insights to dealers interested in exploring this opportunity.

Understanding the Concept of Protective DOWC

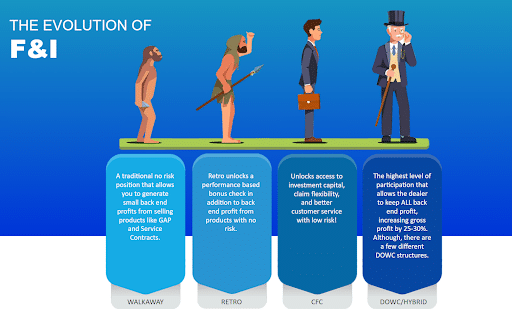

Before diving into the process of creating a Protective DOWC, it is essential to understand what it is. Essentially, a Protective DOWC is a unique structure that allows dealers to optimize their Finance & Insurance (F&I) program by leveraging the tax advantages typically associated with the insurance industry. In essence, it presents a powerful wealth-building opportunity for dealerships.

In a Protective DOWC structure, a dealer forms a separate C-corporation that controls the entire service contract transaction and all funds, including investments. This new entity becomes the provider of the contracts, offering an alternative to using a third party to hold reserves. Importantly, this new entity is treated as an insurance company for tax purposes.

The Benefits of a Protective DOWC

Now that we have a general understanding of what a Protective DOWC is, let’s delve into the benefits it offers.

- Tax-Deferred Nature: A Protective DOWC allows a dealer to capitalize on the same tax laws that insurance companies have been using for years. The company essentially has no taxable income for an extended period due to numerous expenses, such as administration and acquisition costs.

- Dealer Control: One of the significant advantages of a Protective DOWC is the control it gives to the dealer. The dealer has full control over their F&I program, including rates, coverages, marketing materials, and even the company name. This ability to customize offerings allows the dealer to create a portfolio of products tailored to a variety of vehicles and consumer needs.

- Profit Retention: Under the Protective DOWC structure, underwriting profits and investment income are retained solely by the dealer’s Protective DOWC. This contrasts with other structures where premiums may be exempt from tax, but investment income returns are taxed at normal corporate rates.

- Domestic Advantage: A Protective DOWC is not a foreign company and allows dealers to benefit from domestic formation rather than maintaining foreign companies. This can provide significant cash flow, and the dealer can also borrow for almost any purpose.

The Process of Setting Up a Protective DOWC

Knowing the benefits of a Protective DOWC is one thing, but how about setting one up? This process may seem daunting, but with careful planning and the right guidance, it can be quite manageable.

Step 1: Find an Administrative Company

The first step in setting up a Protective DOWC is to locate an administrative company that can handle claims administration and assist in the formation process. The administrative company should be able to provide timely financial reporting, quality claims processing, and help the dealer principal understand the concept of a Protective DOWC. strative Company

Step 2: Incorporate the Entity

Once the administrative company is selected, the dealer principal needs to incorporate the entity. This involves filing articles of incorporation with the state, creating bylaws, and issuing shares to the shareholders. The Protective DOWC can now open bank and brokerage accounts for investing the proceeds of the contracts.

Step 3: Gain State Approvals

After the entity is incorporated, the next step is to seek approvals from the state or states where the Protective DOWC will sell policies. A quality administrative company should be able to assist with this process, which can vary from state to state.

From Formation to Operation

Once the Protective DOWC is formed, it becomes operational, acting as any other corporation. Sales come in, expenses go out, and the net result is a profit or loss. However, it is crucial to note that the Protective DOWC’s financial accounting for service contract sales should be based on the National Association of Insurance Commissioners (NAIC) or generally accepted accounting procedures (GAAP). An important aspect here is that the administrative company should supply a balance sheet and income statement to the Protective DOWC monthly, allowing the dealer/shareholder to track the company’s financial position.

Taxation of Protective DOWC

For state law purposes, the Protective DOWC is considered a normal corporation. However, for federal tax purposes, the Protective DOWC is considered an insurance company if it meets certain criteria. This allows the Protective DOWC to benefit from a pro-rata inclusion of premium income and full expensing of acquisition costs in the year incurred.

Partnering for Success

Setting up a Protective DOWC is not just about understanding the concept and the process involved. It also requires partnering with an experienced provider. This is where F&I Direct comes into the picture. F&I Direct has helped its Dealer Partners become exponentially more profitable by maximizing the Return on Premium instead of eating away at it with fees like most insurance companies. They can show you exactly how you’re losing money with a Dealership Diagnostic.

In conclusion, setting up a Protective DOWC is a process that involves understanding the concept, acknowledging the benefits, setting it up, and operating it effectively. With the right guidance and partnership, a Protective DOWC can be a game-changer in optimizing a dealership’s F&I program.