Reinsurance is a risk management strategy used by automotive dealerships to protect themselves against financial losses caused by unexpected events such as accidents, natural disasters, and other unforeseen circumstances. Essentially, reinsurance is insurance for insurance companies. By transferring some of the financial risk associated with auto policies to a reinsurance company, dealerships can protect themselves against catastrophic losses.

Reinsurance is important for automotive dealerships because it helps them to manage their risks and protect their bottom line. With the increasing complexity of modern vehicles and the rising costs associated with repairs, the potential for financial loss is greater than ever. Reinsurance programs can help dealerships to mitigate these risks and reduce the impact of unforeseen events on their business. The benefits of reinsurance programs include greater financial stability, improved risk management, and the ability to offer more competitive insurance products to customers. With the right reinsurance program in place, dealerships can increase their profitability, improve their financial performance, and provide better service to their customers. Overall, reinsurance is an essential tool for automotive dealerships that want to protect themselves against financial losses and stay competitive in a challenging marketplace.

Benefits of Reinsurance for Automotive Dealers

Increased Profitability

Reinsurance programs can help dealerships increase profits in a few ways. By retaining a portion of the risk associated with the extended warranties, vehicle service contracts, and other F&I products that they sell, dealerships can potentially earn additional income through underwriting profits. Reinsurance also allows dealerships to benefit from investment income earned on the premiums collected from customers, which can be a significant source of revenue. Additionally, by controlling the underwriting process, dealerships can customize the terms and conditions of their products, which can help them stay competitive and attract more customers. Finally, by participating in a reinsurance program, dealerships can gain greater visibility into the claims experience of their products, which can help them refine their offerings and improve customer satisfaction. Overall, reinsurance programs offer a valuable opportunity for dealerships to generate additional revenue and strengthen their F&I business.

Risk Management

Reinsurance programs can help dealerships manage risk and protect against unexpected expenses in a few ways. First, they provide a layer of financial protection by covering the cost of claims that exceed the dealership’s self-insured retention (SIR). This helps to prevent unexpected expenses that could negatively impact the dealership’s financial stability.

Reinsurance programs also provide the dealership with greater control over the claims process, as they can set their own deductible and SIR limits and have greater flexibility in managing claims. Additionally, reinsurance programs can help dealerships to better manage the financial risks associated with extended warranty and vehicle service contract programs by providing a source of funding to cover potential losses.

Another benefit of reinsurance programs is that they can help dealerships to better manage their cash flow. By setting aside funds in a reinsurance account, the dealership can better manage its cash reserves and avoid having to dip into its operating funds to cover unexpected expenses. This can help to ensure that the dealership has the resources it needs to continue operating and serving its customers.

Overall, reinsurance programs can help dealerships to better manage risk and protect against unexpected expenses, which can ultimately lead to increased profitability and long-term success.

Flexibility

Reinsurance programs not only provide dealerships with financial benefits but also help them retain customers. Offering extended warranties, maintenance packages, and roadside assistance can make customers feel more secure about their purchase and provide them with added value.

When dealerships offer these types of services, they are providing peace of mind to their customers. Customers are more likely to trust a dealership that offers these services, as they know they will be taken care of if something goes wrong with their vehicle. This can lead to increased loyalty and repeat business.

Furthermore, reinsurance programs can help dealerships build relationships with customers. By providing exceptional service and value, dealerships can foster positive relationships with their customers, leading to word-of-mouth referrals and increased sales.

Overall, reinsurance programs are an excellent way for dealerships to retain customers by providing added value and peace of mind. By offering extended warranties, maintenance packages, and roadside assistance, dealerships can build strong relationships with their customers and create a loyal customer base.

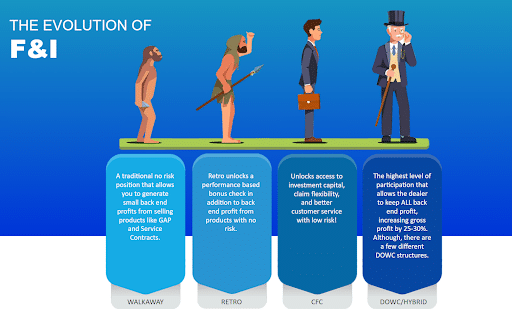

Types of Reinsurance

Dealer Owned Warranty Company

A DOWC (Dealer Owned Warranty Company) is a type of reinsurance program that allows dealerships to provide vehicle service contracts, extended warranties, and other aftermarket products to customers while retaining a portion of the profits. Essentially, the dealership creates its own insurance company to handle these products, which allows them to control pricing, coverage options, and claims processing.

One of the key benefits of a DOWC is increased profitability for the dealership. By creating their own insurance company, dealerships can generate revenue from the sale of these products, rather than just acting as a middleman for third-party providers. Additionally, the dealership has more control over the pricing and coverage options offered, allowing them to tailor their offerings to the specific needs of their customer base.

Another benefit is increased customer loyalty and satisfaction. By offering extended warranties and service contracts through a DOWC, dealerships can provide added value to customers, giving them peace of mind and protection against unexpected expenses. This can lead to increased customer retention, as well as positive word-of-mouth referrals.

Overall, DOWCs can be a powerful tool for dealerships looking to increase profits and provide added value to their customers.

Capped Reinsurance

Capped reinsurance programs are a type of reinsurance arrangement that dealerships can use to manage risk and increase profits. In a capped reinsurance program, the dealership pays a premium to an insurance company, which then assumes a portion of the risk associated with the dealership’s service contracts or other related products.

The key advantage of capped reinsurance programs is that they allow dealerships to retain a portion of the profits from the sale of service contracts or other related products, while also providing a mechanism to manage risk. By capping the amount of risk assumed by the dealership, a capped reinsurance program can help to protect against unexpected expenses, which can help to maintain profitability over the long term.

In addition, capped reinsurance programs can also provide added flexibility in terms of pricing and underwriting. Because the dealership is assuming a portion of the risk, they may be able to offer more competitive pricing on service contracts or other related products, which can help to attract and retain customers.

Overall, capped reinsurance programs can be an effective way for dealerships to manage risk and increase profitability, while also providing added value and peace of mind to customers. By working with a reputable insurance provider, dealerships can create a customized reinsurance program that meets their specific needs and helps to ensure long-term success.

Excess of Loss Reinsurance

Excess of loss reinsurance is a type of reinsurance agreement where the reinsurer agrees to cover losses that exceed a certain predetermined amount, called the retention limit. The dealership pays a premium to the reinsurer for this coverage, and in the event of a claim that exceeds the retention limit, the reinsurer reimburses the dealership for the amount above the limit, up to the policy limit.

Excess of loss reinsurance can be beneficial for dealerships that want to protect themselves against catastrophic losses or unexpected events that could severely impact their financial position. For example, if a dealership experiences a large number of claims due to a major weather event or natural disaster, excess of loss reinsurance could help mitigate the financial impact. It can also help dealerships manage their risk exposure and provide them with greater financial stability and peace of mind.

However, excess of loss reinsurance can be expensive and may not be necessary for all dealerships. It’s important for dealerships to carefully consider their risk exposure and consult with a qualified insurance professional to determine the appropriate level of coverage and type of reinsurance program that best suits their needs.

Choosing a Reinsurance Program

Factors to Consider

Dealer owners should consider several factors when choosing a reinsurance program, including the cost of the program, their risk tolerance, and regulatory compliance requirements. The cost of a reinsurance program can vary depending on the coverage and the level of risk the dealer wants to transfer. Dealer owners should also consider their risk tolerance, or how much risk they are willing to assume, as this will impact the level of coverage they choose.

Additionally, regulatory compliance is a crucial factor to consider. Dealerships must comply with various state and federal regulations, such as the Gramm-Leach-Bliley Act (GLBA) and the Driver’s Privacy Protection Act (DPPA), which govern the handling of consumer information. Therefore, it is essential to select a reinsurance program that meets all regulatory requirements.

Furthermore, it is important to evaluate the financial stability and reputation of the reinsurance company. Dealer owners should consider the company’s track record and financial ratings to ensure that they can meet their obligations if a claim arises.

Overall, dealer owners should carefully evaluate their options and choose a reinsurance program that aligns with their financial goals, risk tolerance, and regulatory requirements.

Working With F&I Direct

F&I Direct is a trusted partner for dealerships looking to navigate the complex world of automotive reinsurance. Our team of experts has years of experience in the industry and can help dealerships find the right program to meet their specific needs. We work with top-rated insurers to offer competitive rates and comprehensive coverage. We also provide ongoing support to help dealerships manage their reinsurance program effectively, including regulatory compliance and risk management. With F&I Direct, dealerships can rest assured that they have a partner who is committed to their success and helping them maximize profits while minimizing risk.

Reach Out Today

Reinsurance is an important tool for automotive dealerships to manage risk, protect against unexpected expenses, and increase profits. There are various types of reinsurance programs available, including dealer-owned warranty companies (DOWC), capped reinsurance, and excess of loss reinsurance, each with their own benefits and considerations.

When choosing a reinsurance program, dealer owners should consider factors such as cost, risk tolerance, and regulatory compliance. It’s important to work with a trusted partner like F&I Direct, who can help navigate the complex reinsurance market and find the right program for your dealership.

By implementing a reinsurance program, dealer owners can provide added value to their customers, retain them by providing peace of mind, and increase profits for their dealership. Don’t miss out on the benefits of reinsurance – contact F&I Direct today to learn more and get started.