Unlocking the Secrets of Profitable Dealership Management

In the latest episode of “Dealer Reinsurance Secrets,” hosts Sean Wiita and Al Salas explore the intricate world of dealership reinsurance, focusing on how different structures can significantly impact a dealership’s success.

Understanding the Various Reinsurance Structures

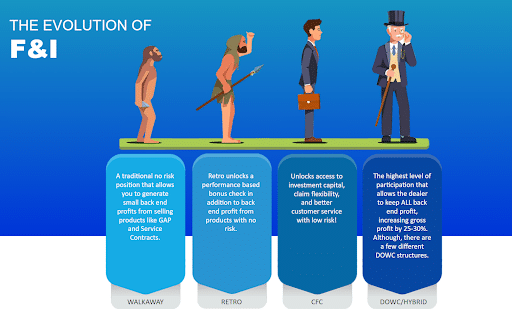

Walk Away Program: The Risk-Free Approach

Ideal for high-risk vehicle portfolios or new dealers, the Walk Away program involves selling F&I products like warranties or gap insurance at a marked-up cost, then stepping away from further risk. It’s a straightforward profit-making strategy without the complexities of reinsurance.

Retro Program: Participating in Profits Without the Risk

Tailored for those cautious about risk or new to reinsurance, the Retro program allows dealers to partake in underwriting profits without facing any repercussions. It offers a balanced entry into reinsurance, where dealers can enjoy benefits with minimal downside.

Controlled Foreign Corporation (CFC): Balancing Risk and Reward

The CFC structure is suited for more established dealers who are ready to delve deeper into reinsurance. It allows participation in both insurance profits and investment income, offering a middle ground in terms of risk and potential rewards.

Dealer Warranty Company (DOWC): The Cutting-Edge Structure

Emerging as a robust alternative to traditional structures, DOWC offers substantial benefits, especially in terms of tax deferral and control over claims and coverage. It’s particularly suitable for dealers with significant volume, looking to maximize profitability and tax efficiency.

Key Insights from Sean Wiita and Al Salas

- Aligning Structure with Goals: Dealers should choose a reinsurance structure based on their long-term vs. short-term goals, cash flow priorities, and stage of business growth.

- Taxation and Investment Implications: Each structure has distinct implications for taxation and investment. For instance, CFCs offer significant tax benefits, while DOWCs provide more control and flexibility in strategy adjustment.

- Adapting to Market Changes: Dealers should select a reinsurance model that allows them to adapt to economic fluctuations, maximizing profits in favorable conditions and reducing exposure during downturns.

Navigating the Reinsurance Landscape

In conclusion, dealership reinsurance offers varied pathways for dealers to enhance their financial stability and growth. Whether opting for the simplicity of the Walk Away program or the comprehensive benefits of a DOWC, understanding these structures is crucial for making informed decisions.

Stay tuned for more insights from “Behind the Lins of Reinsurance” as we continue to unravel the complexities of dealership reinsurance.