How to Recognize if Your Dealership is being 4-squared by Insurance Companies

In the intricate world of automotive dealerships, dealer principals are accustomed to scrutinizing every expense, from vehicle procurement to the smallest parts inventory. Yet, when it comes to the true cost of Finance & Insurance (F&I) products, clarity often fades into obscurity. Alarmingly, research indicates that a staggering 72% of dealers are subjected to opaque pricing tactics by their product providers, a practice reminiscent of the notorious “4-square” sales strategy. This lack of transparency not only muddies financial waters but can drain hundreds of thousands of dollars from dealers’ coffers annually.

The Elusive 4-Square of F&I Products

The term “4-square” is used metaphorically here to describe a tactic where attention is diverted to one aspect while significant details are obscured, leading to disadvantageous terms for the dealer. This strategy is not limited to sales negotiations but extends into the realms of reinsurance programs for F&I products, where insurance companies may divert focus towards administrative fees while concealing other, more costly charges.

- Insurance companies often divert the dealers attention towards the administrative fee, only to sneakily introduce additional hidden fees and packages.

- The Insurance company often takes advantage of investing the dealers unearned premiums as well as not maximizing an investment strategy for the Dealer Principal. This snowballs in the short term and long term miss revenue for the dealers portfolio.

- The lack of general information leaves dealers in the dark about what’s really going on behind the scenes of reinsurance. The dealer should net more without changing anything, just by lowering costs.

The Veiled Complexities of Dealership Reinsurance

Dealership reinsurance offers a lucrative opportunity for auto dealers to capture additional revenue from extended warranties and insurance products. By establishing their own reinsurance company, dealers can retain a portion of the risk and, more importantly, the profits generated from these products. However, the path to optimizing these benefits is fraught with obfuscations, particularly regarding the administrative fees and other hidden costs that can erode profits.

Exposing the Hidden Costs

Insurance companies often emphasize the reinsurance “Admin Fee” to dealer principals. Yet, this focus masks a plethora of additional fees that, though they might appear inconsequential at first glance, cumulatively can impose significant financial burdens on dealerships. From ceding fees that remain undisclosed to loss adjustment fees that inexplicably duplicate administrative costs, and overcharged premium taxes, the landscape is riddled with financial pitfalls that can significantly impact a dealership’s bottom line.

The Importance of the Right Reinsurance Structure

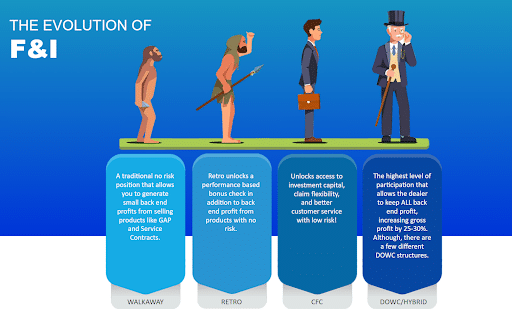

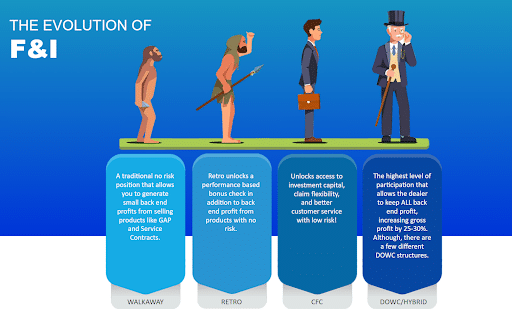

The choice of a reinsurance structure—whether a walkaway, retro, Controlled Foreign Corporation (CFC), or Protective Dealer-Owned Warranty Company (Protective DOWC)—can have profound implications on a dealership’s financial health. Many dealerships find themselves in arrangements that, while seemingly profitable on the surface, are not aligned with their best financial interests due to misinformation or a lack of comprehensive understanding of these structures.

Walk Away:

- Walk away is when you sell the Insurance companies products, but take no part in how they earn out, as well as avoid any risk associated with the contracts sold. Manufacturers aim to keep their dealers here as it allows them to benefit from all of the Dealsership’s customers’ premiums. Although there is some perceived value for a dealer to work with their manufacturer, we find that it is often overstated. The best thing to do in this situation is to make sure you have all the information about the advantages in the other structures to be able to make an informed decision. Speaking strictly from a potential earning standpoint, this is the best setup for stores that sell less than 8 contracts per month.

Retro:

- A Retro Reinsurance Structure typically works best for stores that sell up to 20 contracts per month and are not large enough to fund larger structures.. In a Retro, the Insurance Company assumes the risk of the contracts, but shares the remaining profit left over on an annual basis after claims are paid. We don’t see too many dealerships placed in a Retro that should be in larger structures as the Insurance Company would have a hard time downplaying the advantages in a CFC or Protective DOWC. The one exception has been manufactures offering kickbacks each month to stores that qualify. They use this as a way to keep the dealer locked into their program by focusing on the money the dealer receives instead of the amount of money they are missing out on by not setting up Reinsurance.

Control Foreign Corporation:

- When most dealers think of Reinsurance, they think of the Controlled Foreign Corporation or CFC. These are generally domiciled offshore and the dealers has access to a wide range of tax benefits and access to capital.

Protective DOWC:

- A Protective Dealer-Owned Warranty Company (Protective DOWC) is designed for auto dealerships to capitalize on the profits generated from selling Finance & Insurance (F&I) products, such as extended service contracts and GAP insurance. This model enables dealers to own and control the warranty company that underwrites these products, thereby retaining a significant portion of the profits that would otherwise go to third-party insurers. Protective DOWCs are particularly beneficial for medium to large dealerships with higher sales volumes. These dealerships stand to gain the most from a Protective DOWC structure due to their ability to generate substantial F&I product sales, thereby maximizing the return on investment in the Protective DOWC. Furthermore, dealerships with robust F&I operations and a strategic focus on customer satisfaction and retention can leverage Protective DOWCs to offer more competitively priced and customized warranty products, enhancing their market differentiation and customer loyalty.

The Role of Insurance Agents: A Double-Edged Sword

The relationship between dealers and insurance agents is crucial, yet it can also be a source of hidden costs. Some dealerships discover that payments directed to agents conceal additional fees or “packs” that significantly inflate the cost of Vehicle Service Contracts (VSCs), leading to substantial financial leakage over time.

Towards Transparency and Fair Practices

The call for transparency in the dealership reinsurance domain is loud and clear. Dealerships deserve clear, forthright information about the costs and structures of reinsurance programs to make informed decisions that safeguard their financial interests. Industry-wide standards and regulations could play a pivotal role in ensuring fair practices, preventing exploitation, and fostering a healthier, more competitive market.

Conclusion: An Advocate for Dealers and a Transparent Future

The automotive warranty insurance market is at a crossroads, with the potential for profound positive change hinging on increased transparency, fair practices, and open communication between dealerships and insurance providers. By advocating for these principles, the industry can move towards a future where dealer principals are no longer left in the dark about the true costs of F&I products, leading to more equitable outcomes for all parties involved.