The automotive reinsurance industry has been a game-changer for dealerships, providing a significant boost to their Finance and Insurance (F&I) profits. By understanding the different reinsurance structures and effectively implementing them within a dealership, dealers can take control of their F&I products and reap the benefits of increased profitability. This comprehensive guide will discuss the ins and outs of automotive reinsurance, and how it can become a major contributor to your dealership’s F&I profit.

What is Automotive Reinsurance?

Automotive reinsurance allows dealerships to participate in the underwriting profit and investment income on the F&I products they sell. These products include vehicle service contracts, GAP insurance, tire and wheel protection, key replacement, and several other dealership F&I products. In essence, reinsurance transfers the risk from the insurance carrier to the dealership’s reinsurance company, giving dealers greater control and a share of the profits.

Dealership Reinsurance Benefits

Improved Customer Satisfaction

By retaining control of the claims process, dealerships can ensure a better customer experience. When a third-party warranty company is in charge of handling claims, they may refuse to pay out, leaving the customer frustrated with the dealership. With reinsurance, dealerships can control how claims are handled, leading to more satisfied customers and increased loyalty.

Tax Advantages

Reinsurance companies offer substantial tax advantages for dealerships. By participating in a reinsurance program, dealers can defer and reduce their tax obligations, leading to increased long-term profit opportunities.

Long-term Profit Opportunities

With a well-managed reinsurance program, dealerships can reap financial benefits over time. In times of economic downturn or slow sales, a reinsurance company can provide a stable source of income to keep the dealership afloat.

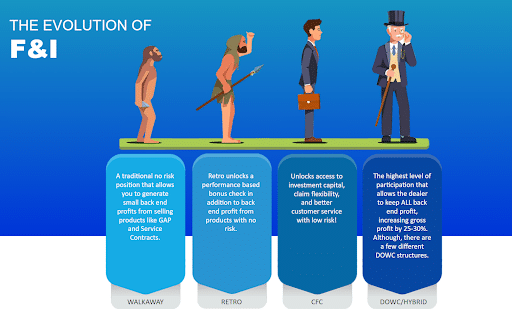

Understanding Reinsurance Structures

There are several reinsurance structures available to dealerships, each with its own set of benefits and risks. Some of the major structures include:

Controlled Foreign Corporation (CFC)

A CFC is a reinsurance company that is owned by the dealer and domiciled in an offshore country. The company’s assets are maintained in U.S. financial institutions, providing more flexibility in investment choices and the ability to take loans against the investment. CFCs allow dealers to cede a maximum of 1.2 million per year in premium and receive 100% of the underwriting profits and investment income.

Noncontrolled Foreign Corporation (NCFC)

An NCFC is a reinsurance company where the dealer owns shares in a foreign corporation, typically with non-voting shares. This structure is generally used by dealers who wish to reinsure a large volume of F&I products. While it provides lower risk, it also offers lower returns compared to a CFC.

Dealer Owned Warranty Company (Protective DOWC)

A Protective DOWC is an administrative corporation owned by a dealer or a dealer group and administered by a third party. These companies can provide more customized contracts and are generally treated as insurance companies for tax purposes.

Evaluating Your Dealership’s F&I Profit Potential

To determine if a reinsurance program is right for your dealership, consider the following factors:

- Your current F&I product sales volume

- Your dealership’s risk tolerance

- Your interest in long-term profit opportunities

- Your commitment to reinsurance loss control measures

If your dealership meets these criteria, a reinsurance program could be a valuable addition to your business model.

Choosing the Right Reinsurance Partner

An experienced and trusted reinsurance partner is essential for the success of your program. Look for a provider that offers extensive training, ongoing support, and a proven track record in the industry. F&I Direct is the industry expert on automotive reinsurance structures and fees, offering a full dealership diagnostic to find profitability holes and unknown profit opportunities.

Implementing Reinsurance in Your Dealership

Once you’ve chosen a reinsurance structure and partner, it’s time to implement the program in your dealership. This process will involve:

- Establishing the reinsurance company, including legal and regulatory compliance

- Developing a comprehensive F&I product offering

- Training your sales and F&I staff on the benefits and features of your reinsurance program

- Monitoring and adjusting the program as needed to maximize F&I profitability

Conclusion

To sum up, Automotive reinsurance can provide a significant boost to a dealership’s F&I profit while improving customer satisfaction and loyalty. By understanding the various reinsurance structures and partnering with an experienced provider like F&I Direct, dealerships can unlock new profit opportunities and secure a more profitable future. Don’t miss out on the potential of automotive reinsurance to transform your dealership’s F&I profitability.