In the ever-evolving landscape of dealership operations, understanding and leveraging the right reinsurance structure is crucial for maximizing benefits and ensuring financial stability.

Sean Wiita and Al Salas, in their insightful discussion on Dealer Reinsurance Secrets, peel back the layers on this complex topic, offering dealers a rare glimpse into the strategic decisions behind reinsurance.

The Importance of Chosing the Right Reinsurance Structure

Reinsurance isn’t just about managing risks; it’s a strategic tool that can significantly impact a dealership’s financial health and future growth. However, the path to selecting the right reinsurance structure is often obscured by a lack of information and transparency in the industry. Sean Wiita highlights how dealers are frequently left in the dark, placed in structures that may not align with their goals or the specific dynamics of their operations.

The Options Available and Their Impacts

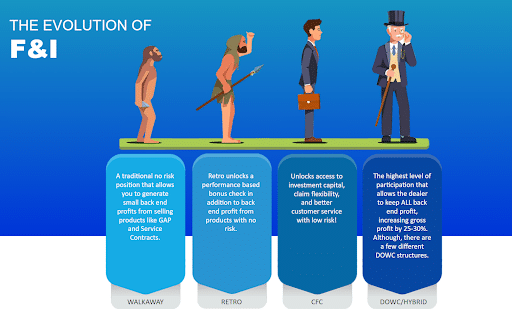

F&I Direct understands the critical nature of this decision-making process. From walk-away programs with no risk and no reward to dealer-owned warranty companies offering significant returns for those willing to embrace risk, the spectrum of options is broad. Each choice comes with its own set of benefits, challenges, and considerations, including risk management, potential rewards, and the impact on future cash flows and access to capital.

A Partnership Approach to Reinsurance

A true reinsurance partner doesn’t just place you in a predefined box; they work with you to understand your dealership’s unique needs, goals, and operational realities. This partnership approach is what F&I Direct prides itself on, ensuring dealers are not only informed about their options but are also supported in making decisions that align with their strategic objectives such as maximizing profit or acquiring new locations.

Making Informed Decisions

Al Salas’s journey underscores the importance of understanding not just the immediate benefits of a particular reinsurance structure, but also its long-term implications for access to capital and financial flexibility. The ability to adjust structures based on evolving business needs and market conditions is a powerful advantage, one that requires a deep understanding of the various reinsurance models available and their respective impacts on a dealership’s financial landscape.

Why F&I Direct?

Choosing F&I Direct as your reinsurance partner means gaining access to a wealth of expertise and a commitment to transparency and education. We don’t just empower dealers with the knowledge and insights needed to make informed decisions about their reinsurance strategies, but we also develop the dealer and focus on the person and their goals instead of treating the dealership and dealer as if they’re the same. Your Dealership can be more profitable, and you get to know exactly how and why!

Ready to Explore Your Reinsurance Options?

If you’re ready to delve into the world of dealership reinsurance and explore the structures that best fit your business model and goals, F&I Direct is here to guide you. With our comprehensive dealer analysis, we can help you understand how different reinsurance options can impact your dealership, from cash flow and investment strategies to risk management and future growth potential.

Schedule a Call with our team today to start a conversation about your dealership’s future. Let us show you how the right reinsurance structure can be a game-changer for your business.

Contact Us for more information on how F&I Direct can help you navigate the complexities of dealership reinsurance, ensuring that you’re making the most informed decisions for your business’s future.

At F&I Direct, we’re more than just a service provider; we’re your partner in reinsurance, dedicated to helping you unlock the full potential of your dealership.